PC enthusiasts and tech buyers may soon face sticker shock as DDR5 DRAM prices are projected to climb dramatically by March 2026. While recent retail trends hinted at stabilizing memory costs, industry forecasts paint a very different picture. TrendForce predicts contract prices for PC DRAM could rise by as much as 60% in the first quarter alone, driven largely by AI-related demand and server module prioritization.

This split between short-term retail stability and long-term contract spikes highlights a market under pressure. Consumers tracking pricing trends may find apparent calm deceptive, as supply constraints and allocation strategies create hidden challenges for buyers.

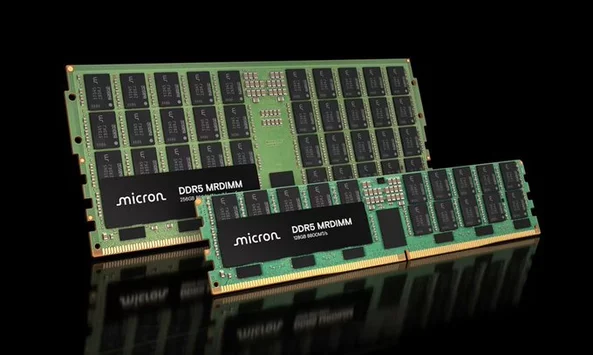

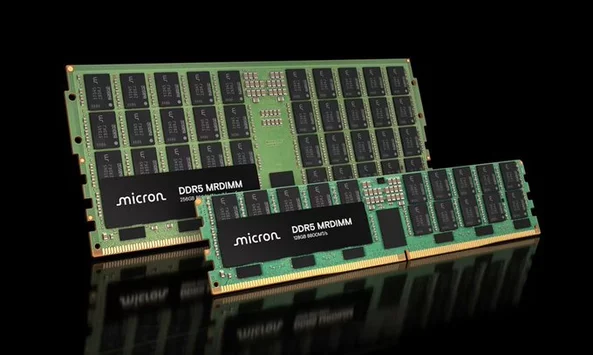

The AI boom has intensified the pressure on DRAM supply, particularly high-capacity DDR5 modules. Data centers deploying AI models require massive amounts of memory, and server-focused modules have absorbed a growing share of wafer output. This prioritization has directly impacted the PC market, leaving laptops and consumer-grade systems competing for the leftover supply.

Memory manufacturers have explicitly adjusted production strategies, favoring large original equipment manufacturers (OEMs) over smaller independent module makers. The result is a tighter market for retail buyers, making high-capacity kits increasingly rare and expensive.

Recent data from PCPartPicker suggested a slowing of retail price volatility for DDR5 kits. On the surface, this might seem like relief for PC builders and tech enthusiasts. However, these averages mask a more complex reality. Forward-looking contracts for PC DRAM indicate substantial increases, reflecting supply prioritization toward enterprise customers and server applications.

This divergence between retail observation and contract reality is creating uncertainty for buyers. While casual shoppers may see minor price fluctuations at stores, long-term market trends point toward significant cost pressures in early 2026.

Memory suppliers are increasingly channeling wafer output toward high-demand server modules. This shift leaves consumer products with fewer available resources, driving up prices for desktop and laptop RAM.

Allocation practices have become more selective, ensuring that large OEMs secure priority volumes while independent sellers receive reduced shipments. This strategy helps stabilize enterprise supply but compounds challenges for the wider PC market. For those building high-end gaming rigs or workstation setups, this means high-capacity DDR5 kits may soon reach $500 per 32GB module, a price point that would have seemed extreme just a year ago.

For PC enthusiasts, gamers, and small-scale builders, 2026 could become the year of tough decisions. Rising DRAM prices may force buyers to either scale back memory capacity, delay purchases, or explore alternatives such as second-hand modules.

The broader market trend underscores a key shift in the tech ecosystem: AI and enterprise demands are reshaping supply chains, impacting consumer hardware availability and costs. As server deployments continue to drive memory demand, retail DRAM prices are unlikely to fall anytime soon, making early budgeting essential for those planning upgrades.

DDR5 DRAM prices are on a steep upward trajectory, fueled by AI workloads and server-first production strategies. Short-term retail trends may offer a false sense of stability, but long-term forecasts warn of sharply higher costs. PC builders and tech buyers should prepare for a market where high-capacity modules become premium purchases rather than everyday upgrades.

DDR5 DRAM Prices Set to Surge Nearly 2x by Ma... 0 0 0 8 2

2 photos

Array