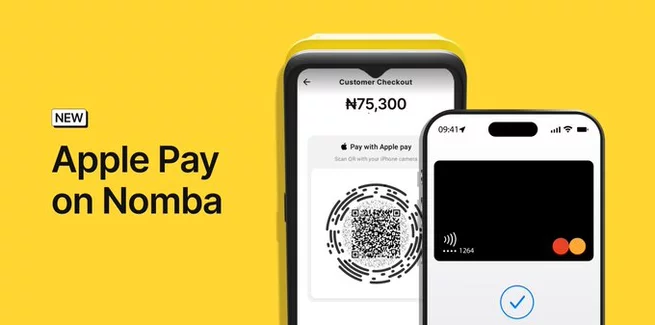

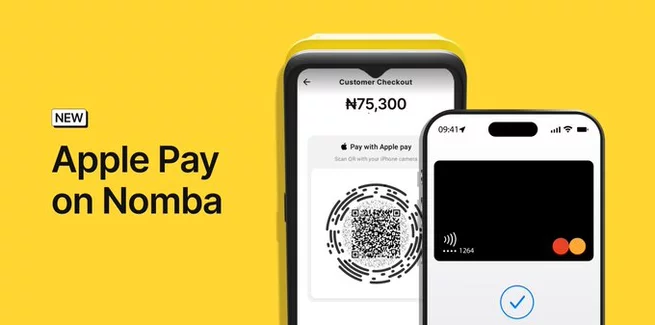

Nigerian businesses can now accept Apple Pay—thanks to fintech leader Nomba. Starting December 2025, merchants using Nomba’s platform can seamlessly process payments from Apple Pay users worldwide, including the millions of Nigerians in the diaspora. This integration eliminates the need for physical cards or clunky bank transfers, offering instant, secure checkouts both online and in-store—addressing a top pain point for Nigerian sellers seeking international customers.

For years, Nigerian businesses have struggled with delayed cross-border settlements, high failure rates, and unpredictable forex charges. Apple Pay’s arrival via Nomba changes that equation. By tapping into Apple’s global payment rails—backed by partnerships with licensed foreign payment entities—Nomba enables merchants to receive funds faster and with fewer intermediaries. Crucially, even if upstream processors lag, Nomba guarantees on-time payouts using its own capital, reducing cash flow uncertainty for small and medium enterprises.

Unlike a full consumer rollout—which would require Nigerian banks to issue Apple Pay-compatible cards—Nomba’s strategy focuses squarely on merchant acceptance. That means any customer with an iPhone and a linked card (anywhere in the world) can pay Nigerian businesses instantly using Face ID or Touch ID authentication. The feature works across Nomba’s physical POS terminals and e-commerce checkouts, making it a flexible solution for restaurants, boutiques, tour operators, and online retailers alike.

Bringing Apple Pay to Nigeria wasn’t just a technical lift—it demanded rigorous compliance. Nomba had to meet Apple’s exacting global security protocols and obtain certifications across multiple jurisdictions. The company’s U.S. Money Transmitter License (MTL) and Money Services Business (MSB) registration were key enablers, allowing it to legally partner with Apple-approved payment processors. “This wasn’t just about convenience—it was about trust,” said Pelumi Aboluwarin, Nomba’s CTO. “Merchants and their customers deserve bank-grade security without sacrificing speed.”

The timing couldn’t be better. In 2024 alone, Nigerians abroad spent an estimated ₦60 billion during December homecoming visits, according to the Nigerians in Diaspora Commission (NiDCOM). With Apple Pay now accepted at local businesses, returning travelers can shop, dine, and pay for services as effortlessly as they would back home in London, New York, or Toronto. For merchants, that translates to smoother transactions, shorter queues, and fewer abandoned sales—especially during peak holiday traffic.

Nomba isn’t the first Nigerian fintech to enable Apple Pay; Stripe-owned Paystack launched a version in 2021, and cross-border specialist Platnova followed in mid-2025. Yet adoption has remained niche due to regulatory bottlenecks and infrastructure gaps. Nomba’s entry—with its dual focus on settlement reliability and merchant experience—could finally push Apple Pay from novelty to necessity in Nigeria’s digital economy.

While Apple Pay’s merchant-side debut is a milestone, broader consumer access in Nigeria still hinges on local banks issuing compatible cards—a move regulators have yet to fully greenlight. Still, Nomba’s move signals growing confidence in Nigeria’s ability to integrate with global payment standards. As more African fintechs bridge international payment rails with local commerce, the dream of truly borderless transactions inches closer to reality—one tap at a time.

Apple Pay in Nigeria: Nomba Brings Global Pay... 0 0 0 3 2

2 photos

𝗦𝗲𝗺𝗮𝘀𝗼𝗰𝗶𝗮𝗹 𝗶𝘀 𝘄𝗵𝗲𝗿𝗲 𝗽𝗲𝗼𝗽𝗹𝗲 𝗰𝗼𝗻𝗻𝗲𝗰𝘁, 𝗴𝗿𝗼𝘄, 𝗮𝗻𝗱 𝗳𝗶𝗻𝗱 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀.

From jobs and gigs to communities, events, and real conversations — we bring people and ideas together in one simple, meaningful space.

Array