The creator economy has exploded into one of the most powerful forces in modern media, with millions earning income through digital platforms. Brands are shifting budgets toward influencers, and platforms are investing heavily in creator-led content. For many, content creation is no longer a side hustle—it’s a full-time career. Yet one big question keeps surfacing: why are creators more visible than ever, but still financially insecure? The answer comes down to a growing imbalance between attention and ownership. Creators generate massive value, but most don’t own the platforms, audiences, or businesses they help sustain.

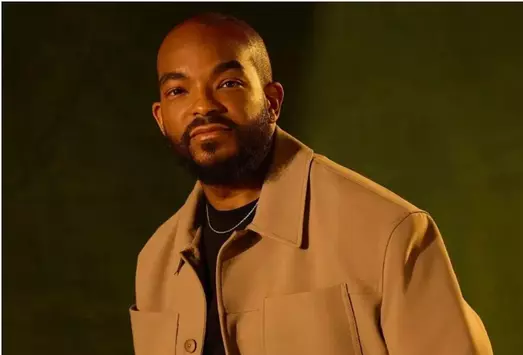

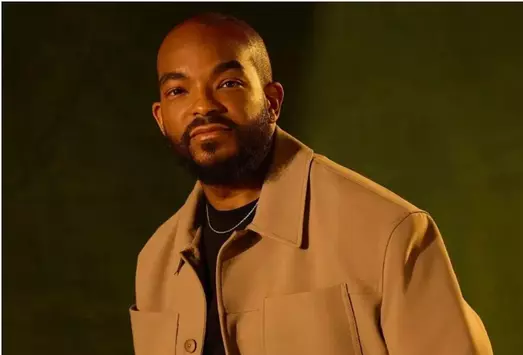

While the creator economy continues to grow, long-term wealth creation hasn’t kept pace. Creators may land sponsorships and viral moments, but stability remains fragile. Most are still building careers on platforms they don’t control. That means their success is often tied to algorithms, account policies, and shifting trends. The boom has created reach, but not security. As Detavio Samuels, CEO of REVOLT and Offscript Worldwide, puts it, the system is still built around transactions, not foundations. Visibility is everywhere—but ownership is rare.

Samuels says he built Offscript to address this very gap in creator economy ownership. Instead of creators jumping from deal to deal, Offscript aims to provide infrastructure for long-term business building. The platform is designed as a vertically integrated ecosystem spanning content, monetization, commerce, and distribution. In Samuels’ words, “The creator drives the vision. We bring the infrastructure.” The goal is simple: help creators stop stitching together fragmented partnerships and start building sustainable ventures. It’s a shift from creators as talent to creators as founders.

For many creators, the ownership issue becomes painfully real when platforms fail them. Cristy, founder of Happy Family Blog, experienced this firsthand when her Instagram account—built over a decade to nearly 100,000 followers—was hacked. Overnight, years of work became inaccessible. “All these channels are rented space,” she explained. Creators don’t truly own their accounts, and support is often minimal when something goes wrong. Algorithm changes, bans, or security breaches can erase livelihoods instantly. That’s the risk of building on digital land you don’t own.

Another major barrier to creator economy ownership is how creators are categorized economically. Frank Poe, a creator-focused attorney and former talent agent, says most creators are still treated as freelancers rather than business owners. Deals are usually structured around flat fees, not equity, royalties, or backend participation. From an industry standpoint, that’s structural: managers and agencies earn commissions on cash payments, not ownership stakes. Equity takes time, and the current representation ecosystem isn’t built to wait for long-term upside. The result is predictable—income stops when posting stops.

Brand sponsorships remain the biggest source of creator income, but they rarely translate into real wealth-building. Creators can drive millions in sales while receiving the same one-time flat payment. Cristy says this happens constantly: “That’s not wealth-building. That’s labor.” Poe adds that even when equity is offered, creators often hesitate. Ownership can restrict future partnerships with competitors, making creators fear being locked into one category. The system rewards flexibility over permanence, even if permanence is what builds generational wealth.

Poe believes creators must approach every opportunity with sharper business awareness. He urges creators to evaluate deals through four lenses: rights, expectations, value, and visibility. What intellectual property are you keeping? Are there exclusivity clauses or behavioral restrictions? Does compensation expire, or does it include royalties and equity? And where will the content live long-term? Creators also need clarity about professional roles: managers advise, agents secure deals, attorneys protect rights. When those boundaries blur, creators become vulnerable to signing away too much too fast.

Both Samuels and Cristy argue that the creator economy must evolve beyond attention. “We need to move into an ownership economy,” Cristy says. That means creators building email lists, memberships, subscriptions, and owned distribution channels. It also means hybrid deals that combine fees with royalties or equity. Samuels frames this moment as a modern-day gold rush, warning that creators—especially Black creators—must not repeat history by building culture without benefiting economically. The next phase will reward those who turn community into an asset, not just an audience.

The creator economy will keep expanding, and brand investment will likely accelerate even further. But growth alone won’t solve the ownership problem. Until creators can reliably own their audiences, negotiate real upside, and build businesses that survive platform shifts, insecurity will remain baked into the system. The future of the creator economy won’t be defined by who goes viral next. It will be defined by who owns what they build, who controls distribution, and who participates in long-term value. The next era belongs to creators who stop renting attention—and start owning outcomes.

Array