Alerts

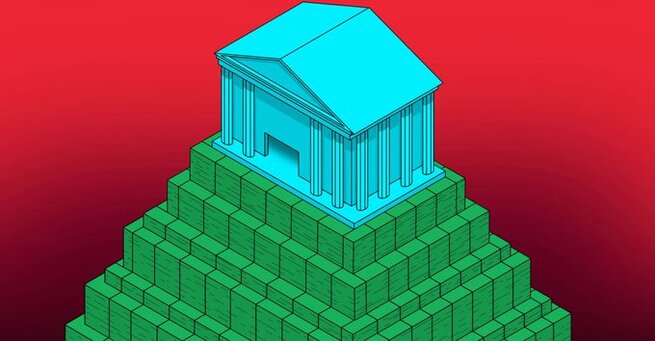

Senator Elizabeth Warren’s latest report reveals a shocking truth: Big Tech tax breaks could’ve funded essential benefits for millions of Americans. Google alone will save $17.9 billion this year, enough to cover SNAP benefits for more than 7 million people. This raises questions about tax priorities and who really benefits from massive corporate giveaways.

According to Warren’s office, Alphabet’s tax savings could fund Medicaid for roughly 2.3 million adults or 5.4 million children. Amazon’s $15.7 billion break could provide SNAP benefits for 6.6 million people, while Microsoft’s $12.5 billion cut might lower ACA premiums for nearly 2 million individuals. These figures illustrate the opportunity cost of giving corporations massive tax advantages instead of investing in social safety nets.

Absolutely. Warren’s analysis highlights that redirecting even a portion of Big Tech tax breaks could significantly improve access to food, healthcare, and basic benefits. Millions of Americans currently face hunger, high medical costs, and financial instability—needs that could be partially alleviated by these corporate tax savings. The senator’s findings emphasize a growing debate over wealth concentration versus public welfare.

Big Tech tax breaks aren’t just corporate perks—they reflect broader policy choices affecting everyday Americans. Understanding how these funds could have supported millions helps voters hold lawmakers accountable for fiscal decisions. Senator Warren’s analysis underscores the urgent need to rethink tax policy and ensure that public resources prioritize citizens over corporate giants.

𝗦𝗲𝗺𝗮𝘀𝗼𝗰𝗶𝗮𝗹 𝗶𝘀 𝘄𝗵𝗲𝗿𝗲 𝗿𝗲𝗮𝗹 𝗽𝗲𝗼𝗽𝗹𝗲 𝗰𝗼𝗻𝗻𝗲𝗰𝘁, 𝗴𝗿𝗼𝘄, 𝗮𝗻𝗱 𝗯𝗲𝗹𝗼𝗻𝗴. We’re more than just a social platform — from jobs and blogs to events and daily chats, we bring people and ideas together in one simple, meaningful space.

Comments